Build the first fully integrated 'Smart Apartment Community' in the region, leveraging technology to reduce costs, maximize tenant satisfaction, and ensure superior occupancy.

Features include smart locks, energy monitoring to cut costs by 10–15%. Smart-enabled apartments yield premium rents.

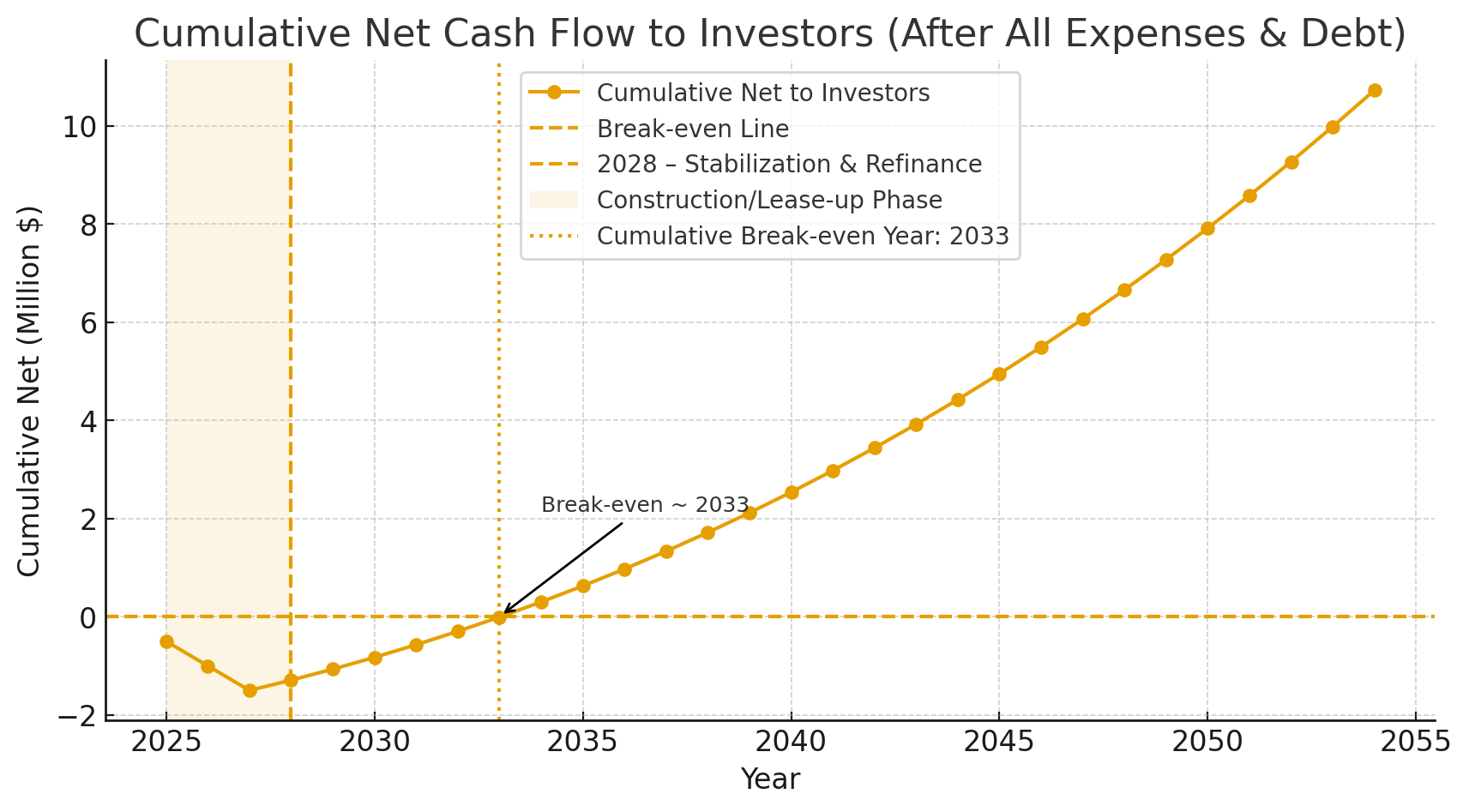

Investment opportunities include an equity raise goal of $6.5M, with a minimum commitment of $100,000, offering projected investor IRR of 14–16% and equity multiple of 1.8x–2.0x.

Sample text. Click to select the text box. Click again or double click to start editing the text.